In 2021, I had written an article titled ‘Long term’ which had a simple premise: when the time comes to invest for the long term, the situation will no longer be the same.

I believe today is that situation - uncertainty in world order (tariffs, Trump-Venezuela/Greenland, etc.), rupee falling, FII outflows, etc.

Prof. Sanjay Bakshi in his interview a year back said something which is quite relevant for today’s situation.

You would not get a bargain in a normal situation unless the market is pessimistic about the specific stock. Broader market corrections are best times to add on.

Opportunities come because there is a lack of clarity; if the business is going to be around for the next 5-10 years, then the question should be whether the price has become so cheap that it becomes sensible to be a partner of the business.

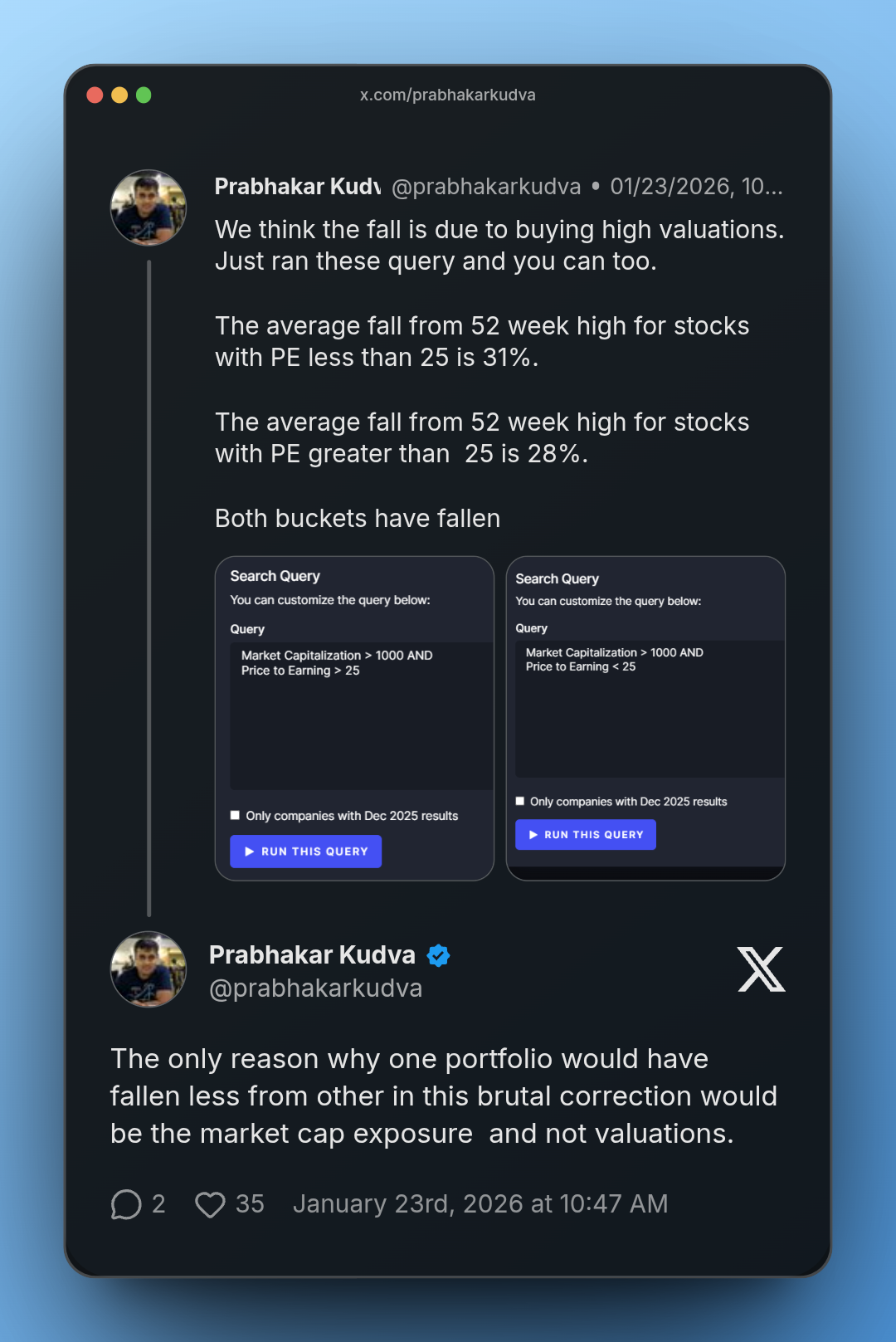

Here is a tweet from Prabhakar Kudva -

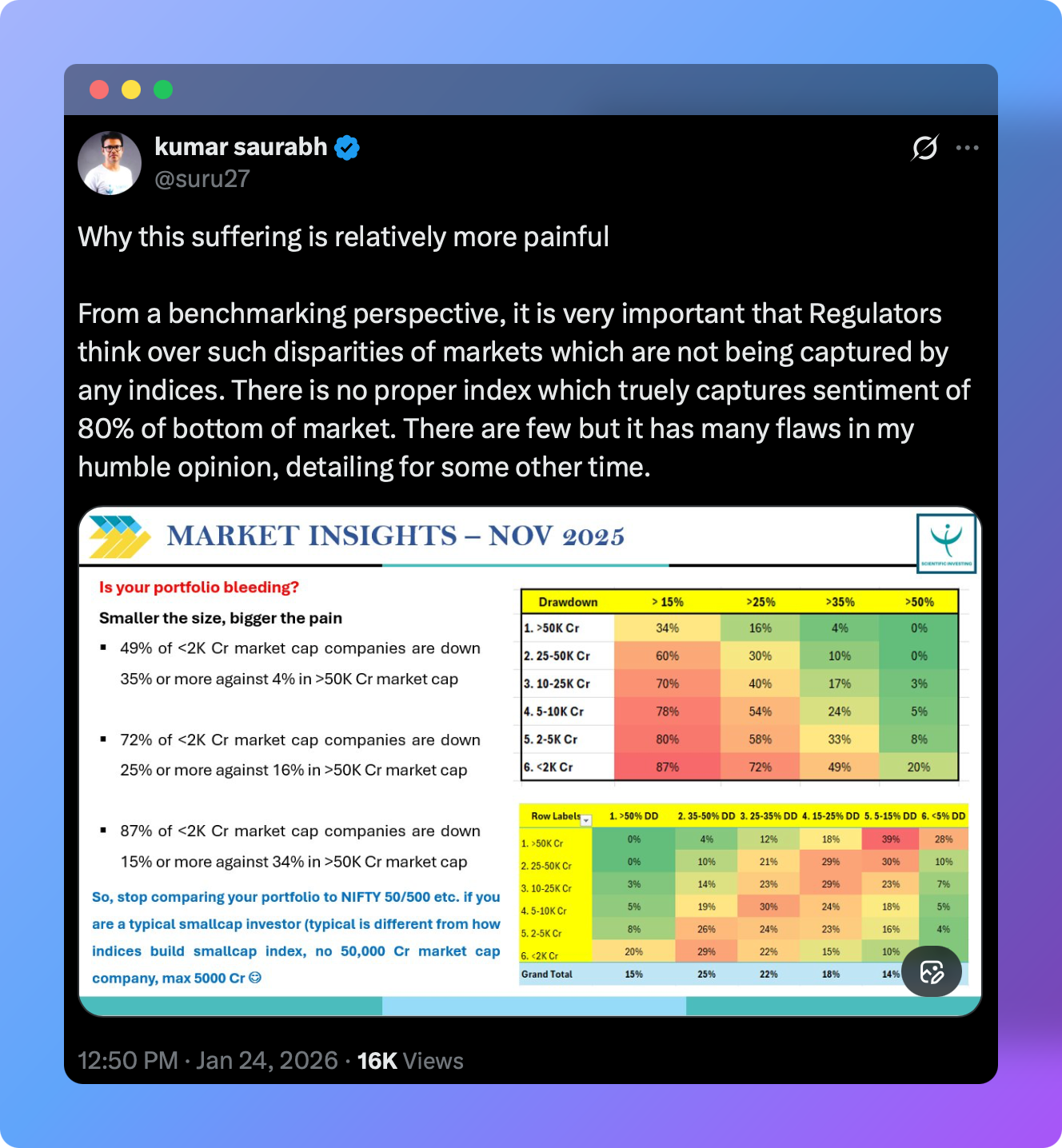

Here is another tweet from Kumar Saurabh -

The message is that this correction was a broader market fall and not stock-specific one. This would be the time where fear is created, and adding positions where fundamentals have not been tampered with would be a good opportunity.

This is where your leap of faith comes in.

Not all players are trading at cheap valuations, but there are some pockets which have been quite interesting. Laying down two sectors where I see pockets of value:

Microfinance Institution (MFI) Sector

This post is not a typical 30-page analysis blog - I will keep it short.

To understand how MFI sector works, refer to my article from 2021 on Arman Financial, where I have written, in collaboration with SOIC, about this sector in detail.

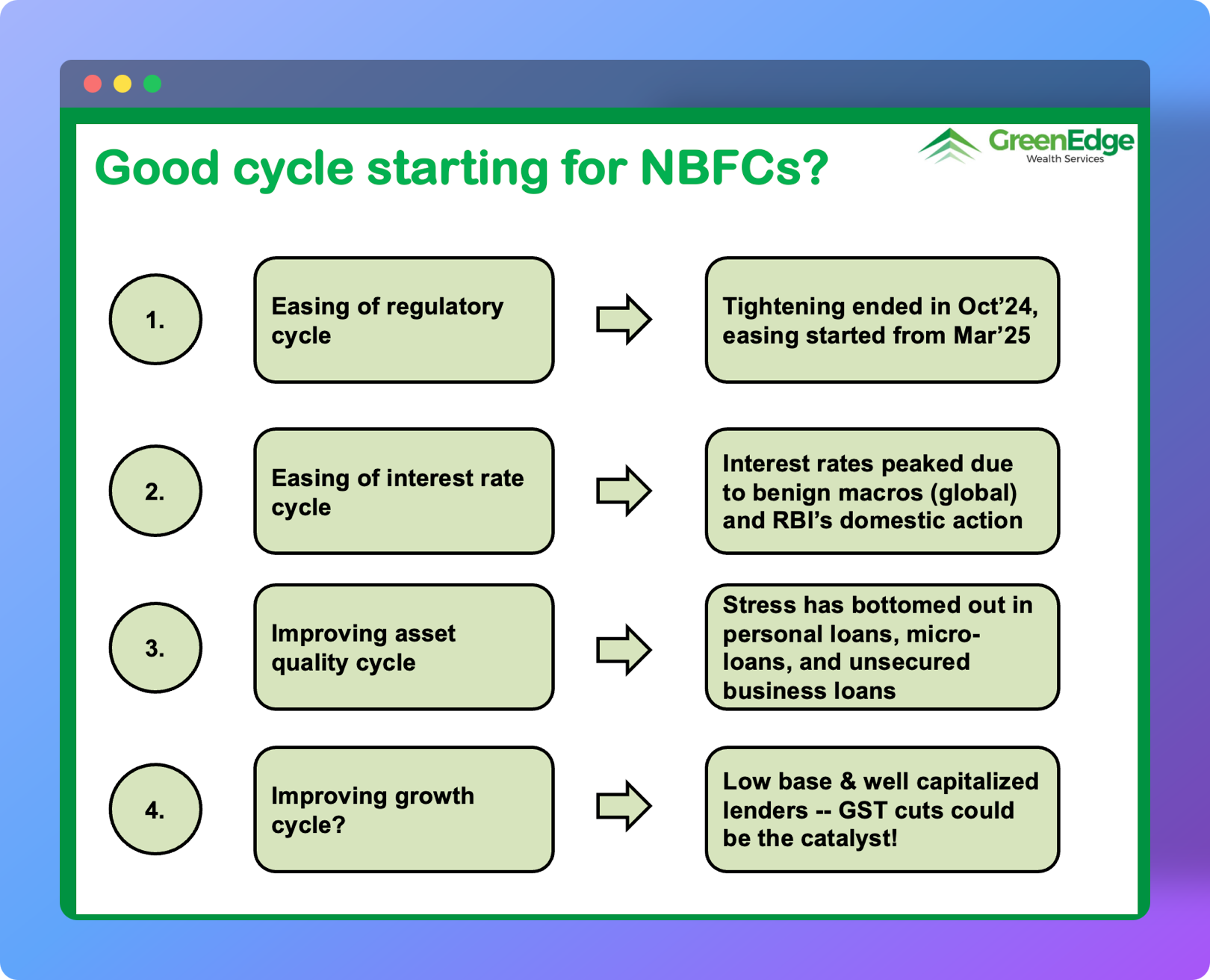

Digant Haria had also shared his insights on the next NBFC cycle; it is important to hear him out if investing in the BFSI sector - link.

Here is a slide from his presentation on what has changed in the sector:

Two names which I like in this sector are Arman Financial and Northern Arc. Here are quick pointers for those:

Arman Financial

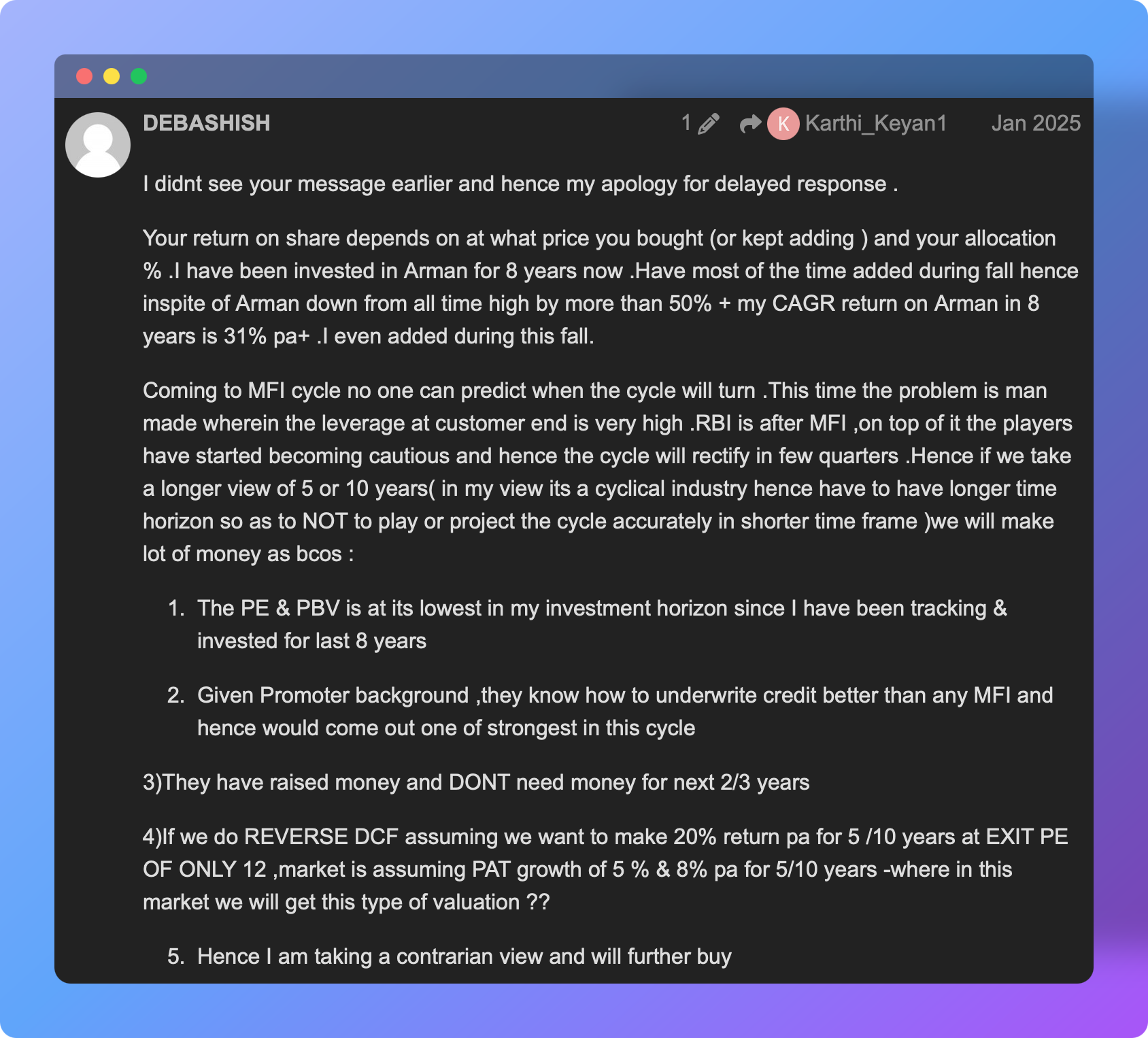

Arman Financial is available at around 1.8-2 times book (while the median is around 3.9-4 times). The last time when Arman was trading at such a valuation was during COVID when everyone thought the business would go bust due to rural demand going to zero because of COVID.

Today things are not as bad as they were during 2020, rather the MFI sector is in a much better place than it was during 2020.

- RBI has started cutting repo rates which is leading to a lower cost of borrowing for Arman.

- Demand revival has started - Ujjivan posted their highest ever Net Interest Income and quarterly distribution. (Ujjivan is a benchmark for understanding when the MFI sector has turned).

- Across the sector the feedback is that the newer books coming in have started showing good quality; and

- Arman’s management has been one of the best in the sector. They are known for their underwriting.

Here are some thoughts from Debashish Neogi who holds around 1% of the company and has been active on the ValuePickr forum:

Northern Arc

Northern Arc has a unique business. Digant Haria has explained it in his blog.

As RBI is reducing the Repo Rate, Northern Arc’s 70% borrowing was on a flowing interest rate, hence borrowing cost is going down now.

The management has guided for 20-22% growth and ROA of 2.8% for this year, along with forward guidance for the next three years reaching ROA of 3.7-4% with growth of 27-28%.

The thesis is simple - Northern Arc has had some troubles in the past for their MFI segment, leading to lower valuations today - currently trading at 1.2 times book. Once the MFI sector turns, the probable bet is in your favour.

Piping Sector

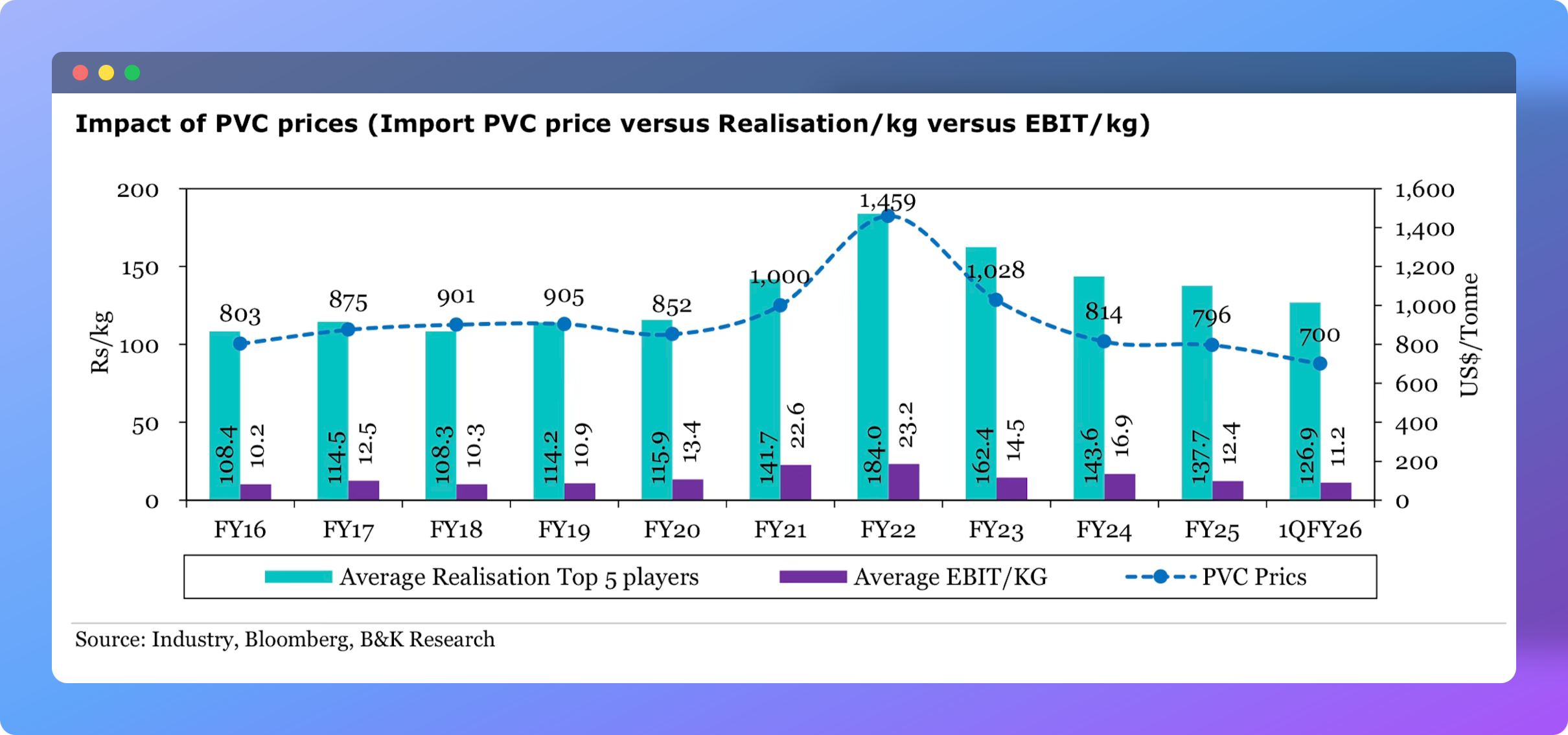

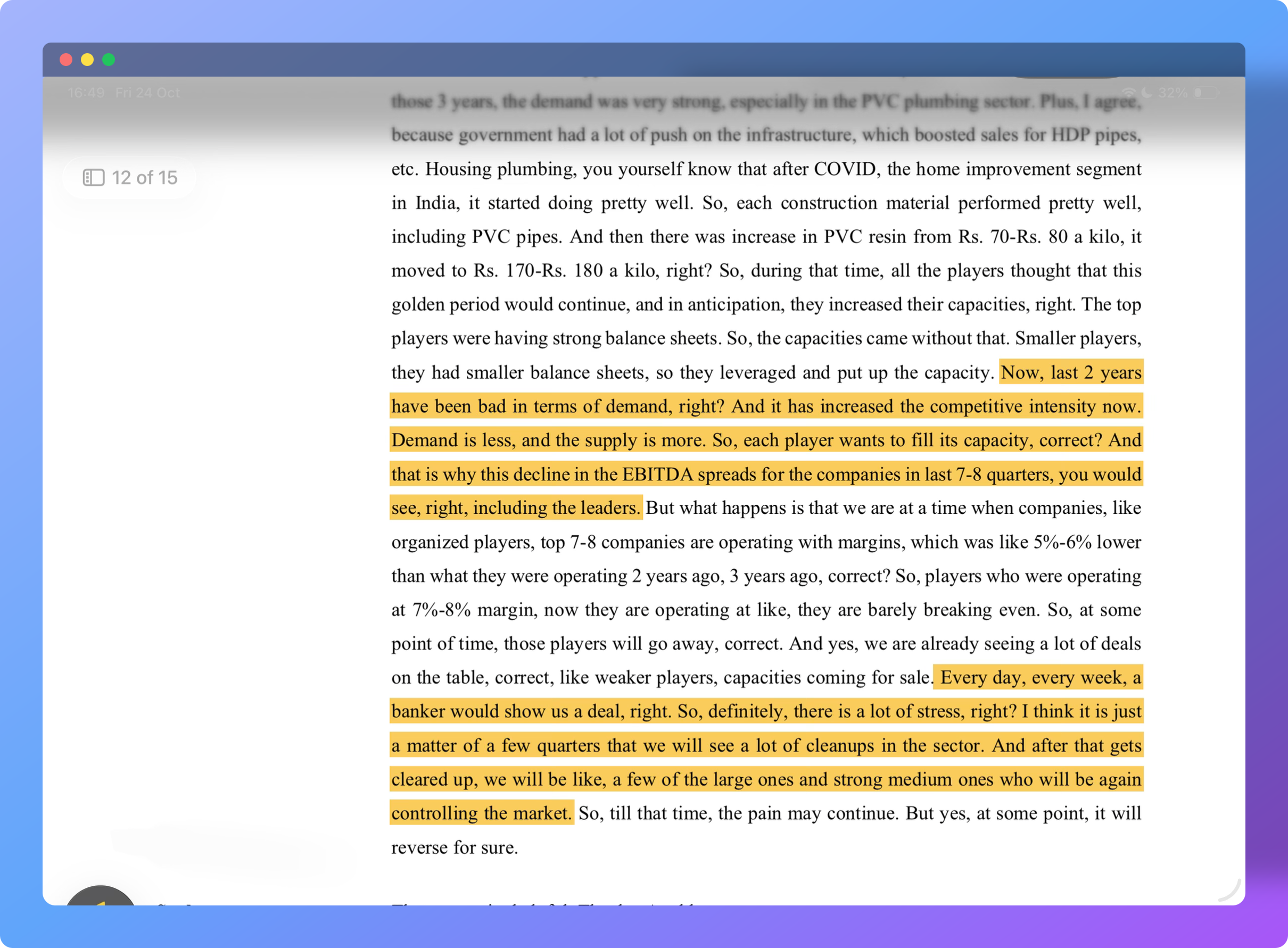

This sector was under the limelight in 2021 when supply chains were disrupted and there was an increase in PVC price, leading to dealers/suppliers pushing sales to profit from higher prices. But this also acts as a double-edged sword as when the PVC prices start dropping, companies face inventory losses.

For understanding the sector, you can refer to two articles I had written earlier, collaboration with SOIC - Prince Pipes and Apollo Pipes.

In this sector, I like two companies - Apollo Pipes and Kriti Industries.

Apollo Pipes

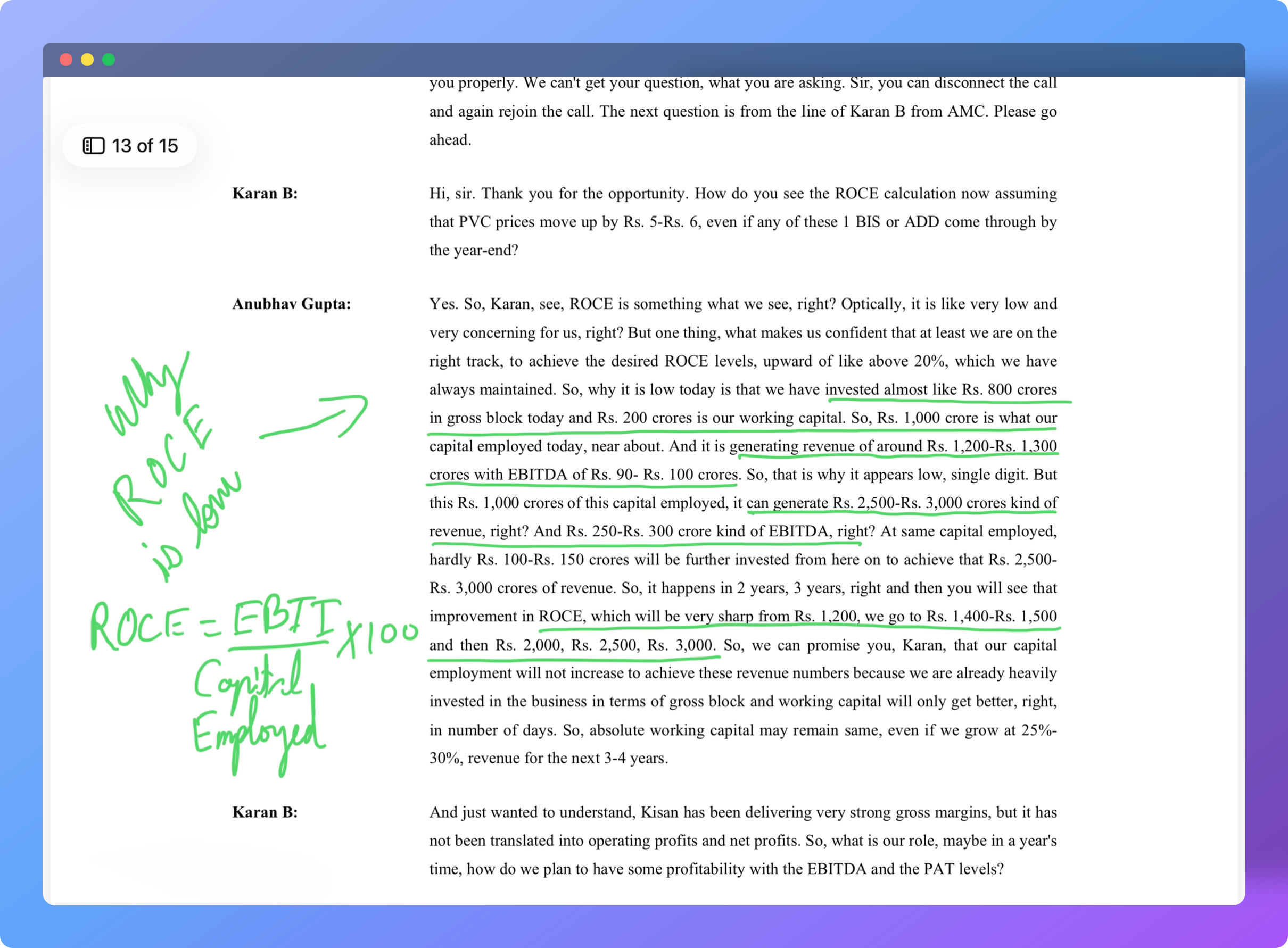

Back in 2021, in my article, I wrote about the gross block having grown 3x in 4 years (2017-2021) from 94 crs to 291 crs. Today, this gross block has doubled in 4 years (2021-2025) from 291 crs to 587 crs.

On a standalone basis - if calculated from 2017 till 2025, the gross block has gone up 6x in 8 years, which is a 25% CAGR. Sales during these years have grown 3.8x with a 18% CAGR.

On a consolidated basis - this number has increased 11 times in 8 years, which translates into a 35% CAGR. Sales during these years have grown 4.4x with a 20% CAGR.

The industry is expecting an anti-dumping duty to come into place, which will lower the volatility of the raw material prices, which will eventually give comfort to suppliers, and they will start stocking their inventory.

But this has been going on for a while and it keeps getting delayed.

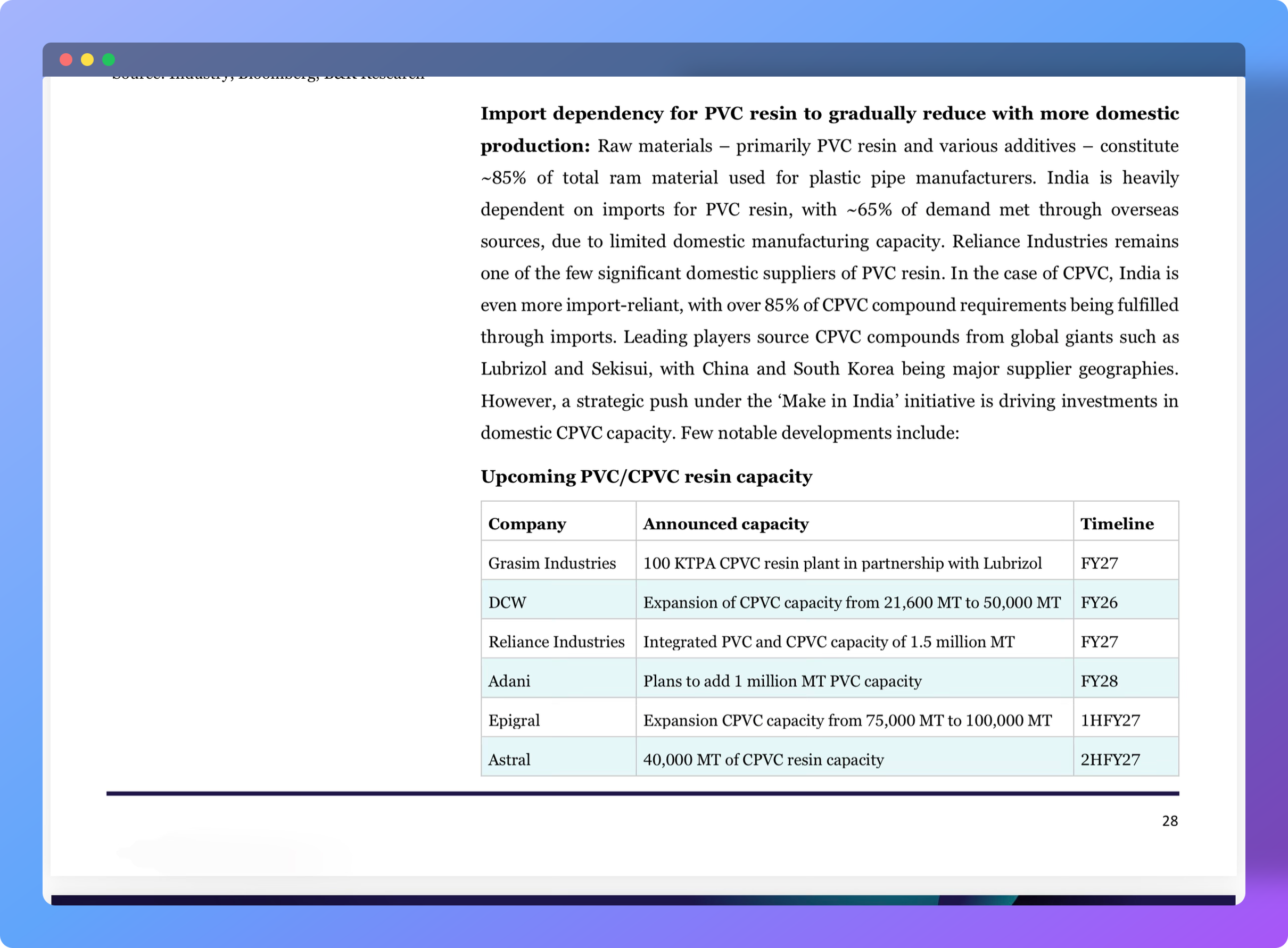

Good thing to note, there is structural change in the industry where players are aware of the problems of this dependency and new domestic supply is coming in. Astral has even setup their own plant to have control over quality and reduce dependency (For details see - Q1FY26).

(Source: B&K Securities)

- Realisations are at its lowest levels - even when compared to pre-covid levels.

Basis the last two quarter conference calls - there are signs of we can see the PVC prices have bottomed out.

- Operating leverage to kick in - Utilisation levels at 45-50%

The only trigger we all wait now for is to demand to come back - rest is all aligned.

- Consolidation - weak players getting acquired

- Incremental ROCE is set to improve

Guidance of market share to double from 2.5 to 5% - but the realisation should support; otherwise, this won’t matter.

Kriti Industries

This company had caught my eye when I saw Madhusudan Kela and Tushar Bohra from MK Ventures were issued warrants at Rs.158.

At this time, the company had a market cap of 1,100 crores (today it sits at 400 crs).

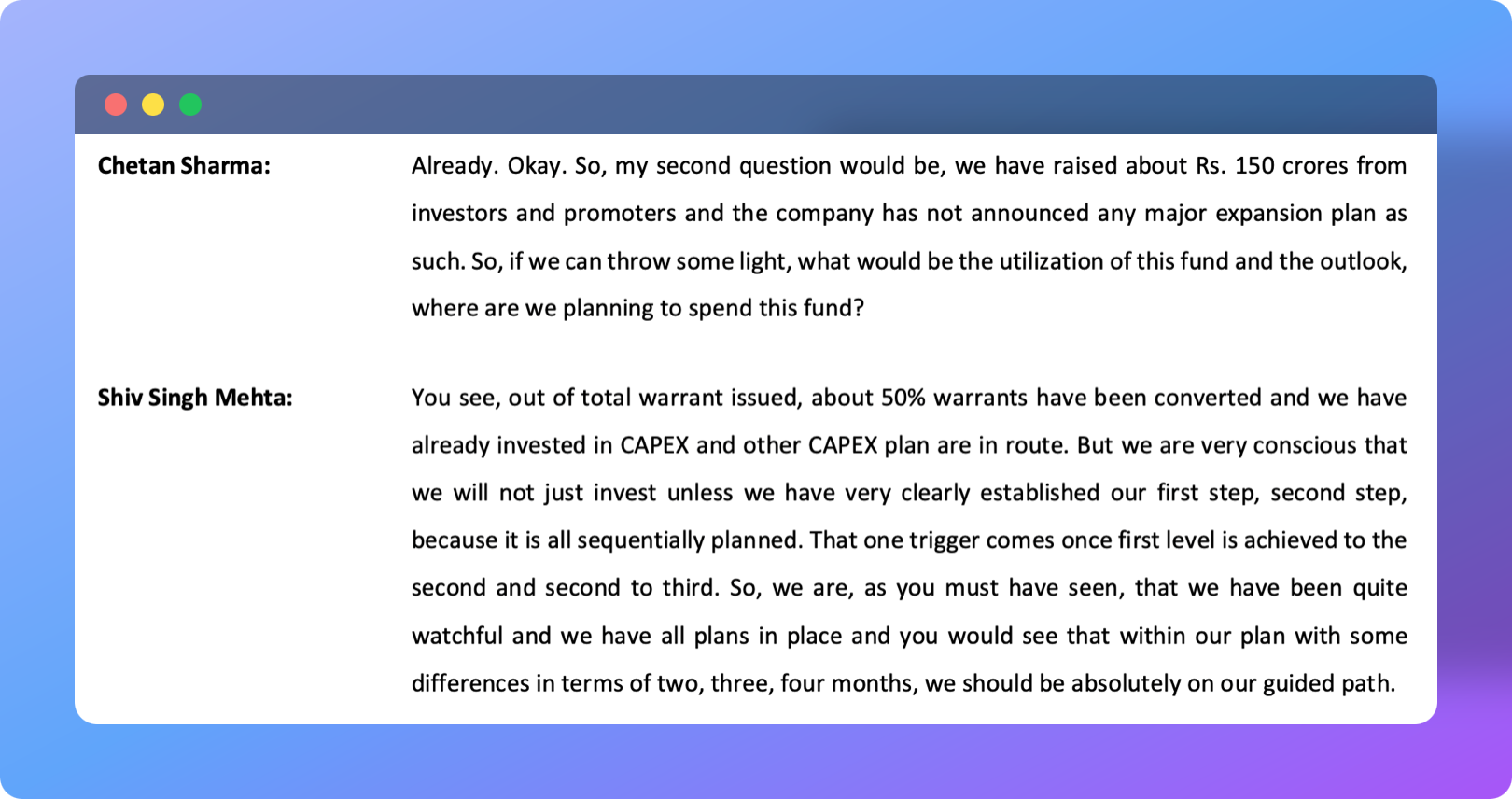

As of date, 50% of the warrants have been converted, and the last date for lapse of such warrants is January 27, 2026. Most probably, they have not converted their warrants as we have heard of no conversion intimation, but this is a question we must ask in the next conference call.

Company holds more than 50% market share in Madhya Pradesh for a long term now, even when the core players are present there, and due to consolidation in the sector, they have gained market share as well.

78% of the product portfolio contributes to the agricultural segment - management’s focus is to shift towards the building material segment.

Most pointers mentioned above for Apollo hold true for Kriti as well.

The thesis is simple - picking up a small player as the cycle turns.

In short

Both sectors seem to be ready for an upturn sooner or later.

Valuations have become attractive, and the probabilistic bet is in your favour - the only trigger left is demand, which has to come sooner or later.

When your style of investing has given you a buy signal, then one must be courageous to take the leap of faith and be greedy.

Here is the cliché quote to end this blog -

“Be fearful when others are greedy, and greedy when others are fearful.” - Warren Buffett