Link to Twitter thread: link

As you read more and more industries one starts to realize that most of the time a player is cheaper than its peers because of valid reasons.

But low multiples of that business makes you very biased to convince you to buy it.

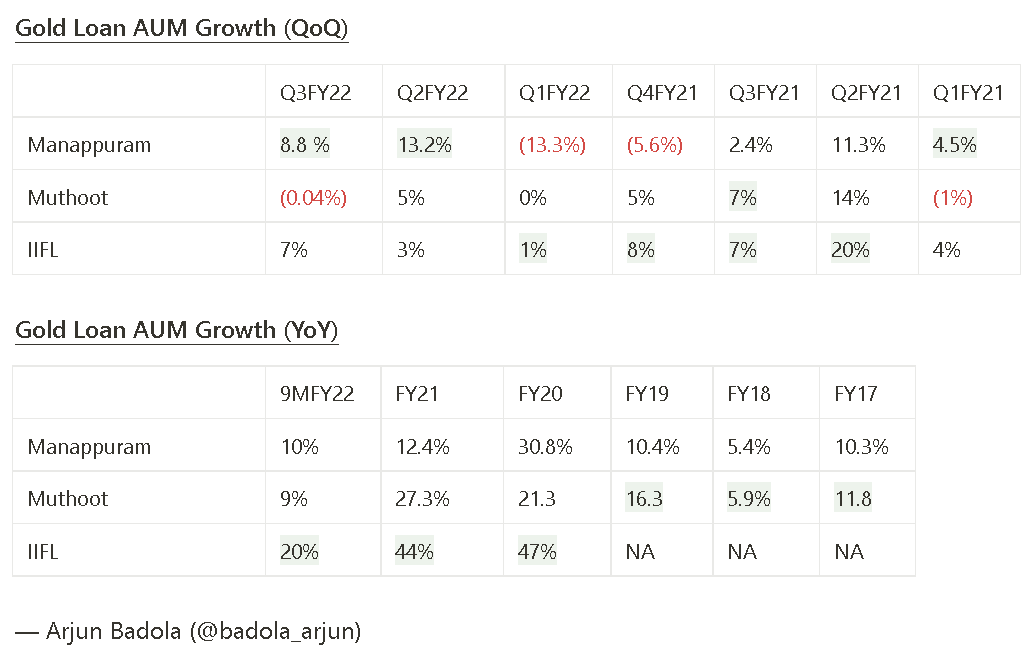

Case #1: Gold Loan Players

Muthoot gets a higher multiple for the right reasons.

Better brand, scaled the business very well, care towards customer, sticking to core segment, etc.

Muthoot even being on a higher base was outperforming Manappuram. Even the growth in recent quarters which Manappuram is showing has come when they decided to lower their yields.

By listening to concall, every quarter there is a new excuse of their under-performance but their peers keep out performing!

It seems that the Manappuram gold loan franchise is weak compared to other players in the market and hence it trades at a cheaper valuation. The promoter has to prove that the business is strong enough to take market share, which is so far not happening.

Since the past 5 years Manappuram’s Price to Book ratio has fallen from 1.9 times to 1.3 times (Reached 3.14 times at peak) whereas for Muthoot it has risen from around 2 times to 3.06 (Reached to 4.6 times at peak).

This does not mean that Manappuram is a bad stock to own. Rather, it has its own risk to reward ratio but in that calculation, valuation should not be the only metric there.

Case #2: Music Streaming

Buying TIPS just because you see Saregama trading at 3 times higher market cap.

Saregama trades at higher valuation for a reason.

- Huge Catalogue: Saregama has around 139k songs compared to TIPS with 29k songs. Just by the number of songs, saregama is 4.5 times of TIPS’s catalogue. Think about the second order effects here - Who would have more bargaining power when negotiating a deal with a streaming platform?

- War chest: Saregama recently did a QIP of 750cr which is going to be directed towards the music business. I find it very difficult for a small player like TIPS to raise that kind of money.

- Professionally Managed: Vikram Mehra, the Managing Director of Saregama is the key player who is providing confidence to the investors, whereas TIPS is a family owned business where Promoter’s son will take over after him. But even TIPS has mentioned they are looking to professionalise their company which is a good thing!

I am not saying that TIPS can’t provide good returns but buying it because it is cheaper than Saregama would not be wise. TIPS has its own reason for which it can be bought.

Case #3: Refractory Industry

Blindly buying IFGL over RHI just based on valuation, could be dangerous.

RHI trades at a premium for a reason.

- RHI Magnesita is a global giant who holds 30-35% market share. This also means they would have a better network around the globe.

- It has the patented technology for specialised value products

- RHI ratios are better compared to IFGL due to their different business decisions: On gross margins RHI wins because of their import and outsourcing of goods structure which reduces employee cost whereas IFGL does a lot of export which brings in high freight costs. (Refer: link)

Inshort

The message I am trying to convey is that a company trading at a cheaper valuation than its peer cannot be your only rationale to buy the company.

One has to dive deep on the reasons for it being cheap and then interpret the possibilities of that changing in comparison with the leader. Then according to individual risk appetite the investor can decide whether to take the bet or not, because the stock, most of the time, would be CHEAP FOR A REASON.