For the new investors out there, the stock market is like a pendulum; it moves between positivism (Bull Market) and pessimism (Bear market). It rarely stays in between where the sentiment is neutral. This was also the main point of the book written by Howard Marks, “Mastering the Market Cycle”. (Notes)

Fun Fact: You may think why is it called Bear and Bull market? It is based on how each of these animals attack.

A bear using his paws attacks in a downward direction whereas a bull by the use of its horns hits in the upward direction (If you have watched Scam 1992 then I am sure you know this).

Further, What do I mean by positivism and pessimism in terms of the market?

In the former scenario one would notice that everyone would believe in the growth story of India, India becoming a superpower, taking over China in terms of economy, etc. whereas in the latter it would be the opposite. You will see statements like India has poor infrastructure, corruption, some Black Swan event, majority of the population is poor, outside competition will take over, etc.

But there will be some companies who will keep compounding their earnings no matter how the sentiment is and you my friend, gonna hunt them down!

Getting back to the topic…

So, I am writing this article to mention one behavioral thing that happens during the bull run or in anticipation of it, that is, the bull market just makes everyone interested in the market!

Since the COVID crash, so many of my friends started getting interested in the market. In my college too, an investment society was formed and a reading group too.

Therefore, I think new investors coming into the market is one of the most prominent signals of a bull market going on. (Not commenting whether it will last or not)

When someone tells me that they started investing after the market crash I feel happy and sad both.

Happy because they started something which will help them in the long run. Sad because I hope they did not get lured by some social media influencer for quick returns.

Sharing some of my interactions with my friends

Friend #1

Got in call with my friend who started investing after the March 2020 crash. I asked him how it’s been going. He told me he is investing in a mutual fund for the short term and will remove the money in August 2021.

I asked him but what if the market crashes before you pull out the money?

He replied that his family CA will call him and alert before that happens. I tried to explain to him that the market is very unpredictable and setting an exact time frame might be very difficult.

But that CA had convinced him very well.

Friend #2

Received a text from an old friend who started learning about the stock market after watching Scam 1992.

He said that he has done studying ‘everything’ about the short term now he is learning long term investing.

He is planning to do investing and trading as soon as he is done with this course he found on Udemy. One advice I gave is to start with small capital to avoid huge losses. To which he replied, “risk hai toh ishq hai’’.

Later, after a few months I had a second interaction with him and this time he had selected his stocks.

He said he would buy FMCG stocks because he uses that product and the demand will never go away. Plus, if we look at their charts they have given good returns.

Friend #3

During the lockdown of 2020 I had convinced my friend to start investing in the market.

He used to invest in the same company which I would pick. But in 2021 he got fed up as for 2-3 months he had received 15-18% return. (These are bull market returns)

Through his college friend he came across Cryptocurrency and saw that the return he was making in the stock market by investing for months could be made in one day in Crypto.

That’s it! He shifted his money from Zerodha to WarizX. The fun part is he in fact did make those returns in a day but not for long.

Soon he was all in but after Tesla decided not to accept Bitcoin, his portfolio went downhill and has been going down since.

Currently he is 50% down and when I ask what’s your plan? He said I don’t want to discuss it because he is too fed up now.

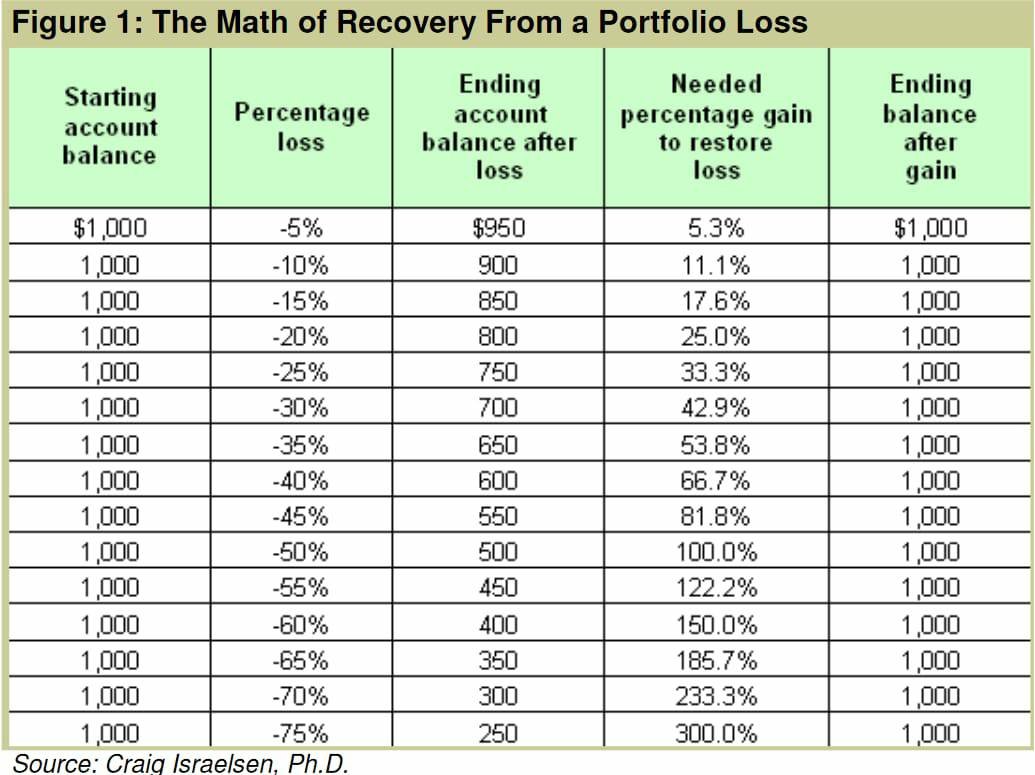

I asked him a simple question: “How much return do you need to get back your capital if you are 50% down?” He replied, “50%”.

Group of people #4

I had met few people through a reading group in my college, there were new to investing but they were certain about one thing that they wanted to build a career around it.

They had never experienced the market but were ready to do it for their whole life.

For one month their enthusiasm was pretty good until it wasn’t. Soon, they realized they had to do too much boring stuff of reading Annual Reports, Concalls, blogs, etc. and the day I got the feeling that these people were not interested, I left the group.

The above incidents were the most prominent ones.

Here are few others short ones

- One of my cousins called my mom to teach her trading and told her, “It’s very easy. You can do it from your phone.” (He has never traded before)

- Few friends inquired about investing and I gave them around 60 mins of my time to explain some basics but then it all went down as they were never actually interested. This one really annoys me. First people would show interest as if they would dedicate their whole life to it and the very next day their so-called passion is gone.

- A friend of mine wanted to become an athlete but now he is suddenly interested in making money from the stock market as it is a “good side income” via trading (as per him).

- Of course, how can we forget Clubhouse. I have met people who recommend which stock to buy in their bio!, people give stock tips and later state that they just follow one of their friends who is into this, etc.

- The most misunderstood one is “invest in what you use”. It doesn’t mean that you blindly start buying shares of companies whose products you use. It just means that you can start reading about those companies. 8/10 times you find this way would be stocks which are already overvalued as the market has already discovered them. But sometimes there will be few gems.

- One of my friend’s dad recently started investing in Bitcoin, because after the crash which happened after Tesla not accepting bitcoin he thinks that it is “cheap” right now.

Honestly, after a certain number of attempts I stop explaining to people about concepts of investing. They just don’t listen. It’s better that they experience it themselves. But, I make sure that they don’t invest too much money which would make them run away from investing.

The purpose of writing this post was that I wanted to show how people around me are behaving and perhaps, I can re-read it after a year or so. I could add in my diary that in 2018, when I used to tell my college friends about investing, nobody was interested whereas in 2020-21 everyone wants to be rich.

All I want to say is that don’t enter the market just because “Stonks” seems cool or your friend made huge money.

Always think in terms of consistency.

Remember, you only need to make one mistake to lose your hard earned money in the market. Here is a chart to show you how much return one needs to recover back their capital:

Inshort

Bull markets go to people’s heads. If you’re a duck on a pond, and it’s rising due to a downpour, you start going up in the world. But you think it’s you, not the pond. - Charlie Munger

Jason Zweig on a podcast mentioned that if one is not passionate about investing, they should not do it. Rather, buy the index and do things which you are passionate about.

I had shared a similar thought in one of my previous posts, It’s Difficult.

The depth of research one has to do to develop conviction requires that itch to learn more.

P.S: Guys don’t worry, people I am talking about in this post don’t read my blog. That is the reason I am openly sharing it out here.