Before we start with this article one must know that there are a lot of ways to be successful in investing and one must follow the style which suits them.

The big question: What does one look for when buying a stock?

Well I believe we are starting off with a wrong question.

Rather, It should be: What does one look for when buying a business?

As soon as you start thinking about buying stocks as buying parts of a business the perception changes significantly.

Let me share with you what changed for me when I started looking at stocks as piece of a business.

Ownership thinking

When looking at stocks as part of a business your focus shifts towards functioning of the business rather on stock price.

Stock price fluctuation stops troubling you and long term view of the business takes the first seat.

You start caring less about what the price charts have to say and more on what the business performance is saying.

Thinking as the owner of a business pops many questions into one’s mind, like

- If you were the owner of the business would you enter into business,that is do you understand the industry?

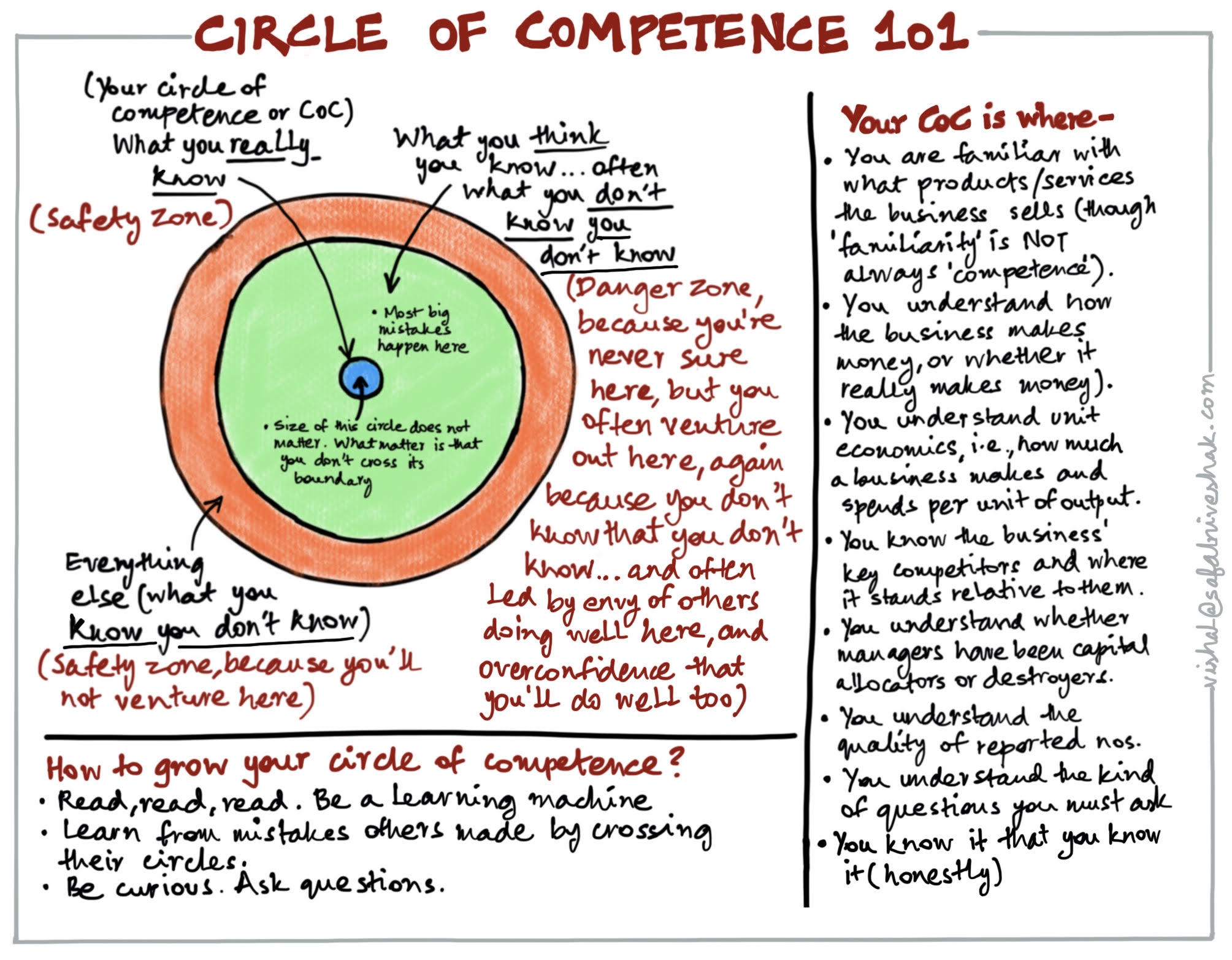

Investing in a business which falls under your circle of competence is the key to good returns.

You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital. - Warren Buffett, 1996 Berkshire Hathaway Letters to Shareholders

I’m no genius. I’m smart in spots—but I stay around those spots. - Tom Watson Sr., Founder of IBM

Here is a photo by Safal Niveshak which explains this concept:

One must understand that knowing everything does not help you succeed in investing instead understanding something deeply which enables you to see things or understand them in such way that others can’t.

Investors should remember that their scorecard is not computed using Olympic-diving methods: Degree-of-difficulty doesn’t count. If you are right about a business whose value is largely dependent on a single key factor that is both easy to understand and enduring, the payoff is the same as if you had correctly analyzed an investment alternative characterized by many constantly shifting and complex variables. - Warren Buffett, 1994 Berkshire Hathaway Letters to Shareholders

- What edge would you have over your competitors?

Now, you have got a business which you understand but what competitive edge(Moat) does that business have?

I believe a business to provide you with good long term returns it must have a sustainable edge(Moat) over its competitors which would enable the business to earn more than its peers.

For example: A lowest cost producer has huge advantage over its peers. As, the company could set a low price that would make difficult for others to survive at that price point hence killing the competition, or

A brand which has been created after heavy advertising for years would have a very loyal customer base. Such brand loyalty would make it very difficult for the new entrant to make the customers switch.

So things like customer loyalty, cheapest product, best quality in an industry where quality matters the most, relations(Trust, past record, corporate governance) matters a lot for survivability of a business.

- Will your business still exist after a decade?

Now even though, if you have the competitive edge which is required to survive in the industry it does not guarantee that the business will survive in the long run.

There could be a possibility that the industry itself is vanished in a decade from now.

The world is changing very fast. Many companies getting closed due to technology advancement but even new businesses are getting setup.

You need to figure out which businesses have the capability to stay alive for a very long time.

As Nassim Nicholas Taleb says, your business needs to be ‘AntiFragile’.

Fragility can be connected with lots of topic but we will stick to the industry for this article.

Lets understand with an example

I would think that IT companies could be categorized as a fragile business. Everyday we have something new which is faster, better and cheaper than the previous technology we were using.

But the same cannot be said for food consumption. If you look at Maggi noodles it was first launched in1983 and is still thriving in their industry. In 2015 they had faced a crisis due to which Maggi was banned but soon it was relaunched with increased price and rest is history.

- Is the industry prone to regulation?

Some industries are heavily regulated which makes difficult for a business to earn good returns.

Government sets price cap for some industries so that it reaches to vast majority of its users. Like: Railways, Power sector, natural resources, etc.

So in a these kind of industries, either government enters into the market and runs the industry by themselves or they set a cap on how much the product can be priced, which makes very difficult for a business to do extremely well. The only thing they do is earn enough to pay the salaries of the employees.

Other category could be sin products: gambling, alcohol, tobacco products, etc these kind of products are taxed heavily by the government. As they are addictive it is very unlikely that a customer stops using it even if there is an increase in price.

Well, I am not saying money can’t be made in these industries but it becomes quite difficult to survive in such industries. (But we do have some exceptions)

- It your business demanding too much inflow of cash?

Growing a business could be really great. But one must understand that where the money is coming from?

If the business is growing using debt or diluting its equity aggressively then we might have a problem.

Its very simple, if you find a business which is growing with internal accruals then you have good business there. This also shows that the business model is working for you.

As there is no support required from outside. (Outside support always comes with cost which can be lethal for a business if not used carefully)

So, to cater that the business would need outside support or not one would start looking at the financial ratios.

You would start looking at ROE, ROCE, & margins of the business. (And other related ratios)

Understanding them and predicting that will they improve in future or sustain lets you understand whether the business would have enough cash to sustain its growth without external support.

- If there would be a crisis around the world, would your product still be in demand?

This one is very controversially question as we never know what kind of crisis could come in the future. So, it is very difficult to answer whether your product/service will be in demand.

But there are somethings which we can say for sure I think.

We would still be using products which are essentials for our needs. Food, clothes, dental products, addictive products, etc. (Like I gave the example of Maggi above.)

People would still be travelling but how that one must figure out.

Everybody would needing space to live and that is limited, hence prices of the property could go high in the long run.

So, thinking like this really lets you understand how strong is your business or we could say business being Antifragile.

Management

After you are finished thinking like an owner you realize that in reality you are actually not the owner. So, what do you?

You start looking for qualities in the management which you would have wanted if you were managing that business yourself.

Example: If you were running a coffee business you would have definitely wanted experience of the industry and great knowledge about coffee blends in the world.

The most common thing which people say to look for is honest and competent management. That is quite essential and important if you do read that statement properly.

As I have seen people just focusing on honesty and not competence. The reason being, to know whether a person is competent or not requires background check with enough knowledge of that field which would allow you to understand the whether what you are reading is true or false.

What other questions could come in your mind?

- You would want the management to be clear and transparent

There should not be any transaction on which the management’s integrity can be questioned or a transaction leading to a lot of ambiguity.

For example having transactions with private entities. This could be a sign of trouble as private companies are not obligated to disclose their financial statements, which makes it easier to hide a mistake.

You don’t want a management which has been proven guilty or has serious allegations on them as we all know, there is never one cockroach in the kitchen.

- It is always preferred that the business is professionally managed unless the family running it has the competence to do so

Like, you would not want the senior management to appoint some relative who is not competent for the job.

Also, If the management is old then one should also think about the succession plans of the company.

- Further one must see, does the management consider growth at any cost?

Investing in a growth company seems very attractive but one must understand at what cost is the growth coming.

- Is the management destroying their previous relations just for a short term gain?

- Whether the profitability is going for toss when company grows?

- Is the product/service quality is going down as growth comes in? (Ex: Yes Bank, Satyam Computers)

This list of questions is not an exhaustive one but it could surely get started.

Valuation

Now after you have gone through the above process, one would think how much money should be paid for a business?

I would just re-create the valuation method I follow which I had mentioned in my CCL Products (India) analysis:

I try to follow the expected return model which is followed by Prof. Sanjay Bakshi. Here is the link to it: (click here)

Its a three step process:

- It must be a business with a Moat

- Taking conservative assumption of performance

- Following uniform exit multiple of 20x for all such businesses as a discipline.

As said by Prof. Sanjay Bakshi such practice provides margin of safety by:

“The idea behind the above is to create multiple sources of margin of safety. The first point delivers a margin of safety by keeping you away from bad businesses. Investors should recognize that margin of safety, apart from a low price, can also come from a high-quality business. The other two points help you think about reasonable valuation a decade from now.“

Inshort

Thinking like an owner of a business really helps you clear your thinking. It lets you focus on what is important(business) and ignore the trivial(stock price).

Finally, what to do after making the investment?

Thereafter, you need only monitor whether these qualities are being preserved. - Warren Buffett, 1996 Letter to shareholders