After reading this article I thought why not put down my thoughts on how there are so many content creators/influencers out there who are just putting out the most basic things and getting huge fame.

Initially it would be very difficult for a beginner to understand that the content creator they are following might not have knowledge about the subject. It’s when you spend months/years reading about the subject you realize how shallow their research was.

There is so much repetitive content out there which many people present as if they have discovered something new. When you start questioning them, you can see that their foundation was not strong.

There were so many handles which were writing blogs/threads or hosting podcasts after COVID crash. Most of them have suddenly vanished. Something I wrote on similar lines - link

Here are few traits of a fake content creator:

- Repetitive knowledge: They will talk about why everyone should invest, ETFs, show their “love” towards investing, make twitter threads like “Here are 10 things I learnt in my investing journey” which they started a few months back, “invest in quality companies” but what really is a quality company?, probably nobody knows.

- Facts without any analysis: Providing you with facts which they get from news articles without any analysis of it. This extends to even writing threads or articles on companies where they will provide the most basic information about the company and tag so many handles to get recognition. Just giving out information on a company is not a quality thread or article, there has to be some analysis which you share along with the company information that is what your value addition is. But such content is still helpful as it could help people to generate ideas.

- “love” towards that subject: Talking only about investing, you will come across statements like “I spend time with people who are like minded”, “I talk about businesses”, “I am a long term investor”, etc. These statements might be looking fine when you read it here but when these handles tweet about it you can see that the statements are baseless. It is really hard to explain but you know it when you see it. It is like when a new investors starts talking about market cycles. In theory the new investor can tell you all about it but once you experience it that makes all the difference. Here is video to explain what I mean: link

- Catchy tweets: Their tweets are going to be something which you won’t be able to resist replying back to, if you have average level of curiosity. Example: “Which was your first stock you bought?”, “What would you do if you got 100 Bitcoins today?”, “Did you buy the dip?”, etc. They will put down the most common advice out there that it will be very natural for you to like it or reply back.

- Reel vs Real: I had interacted with a content creator a few months back who used to talk so much about direct stocks picking and finance on their twitter handle. When I asked what business are you reading these days, there was no answer. Rather they said they don’t do direct stock picking, which is totally fine but at least be open about it and not give advice on how to do direct stock picking or give advice like “if you liked it at Rs.100 you should like it more at Rs.50”. They will start conducting webinars/podcasts/twitter spaces about topics (like Crypto Currency or Web3) even industry experts themselves don’t know about, with the confidence up the roof!. So, you would be wondering how they conduct such events? YouTube to the rescue. It is extremely easy to understand the upper layer of any topic by a few days of reading, but the true understanding comes with your diving deep for a good amount of duration.

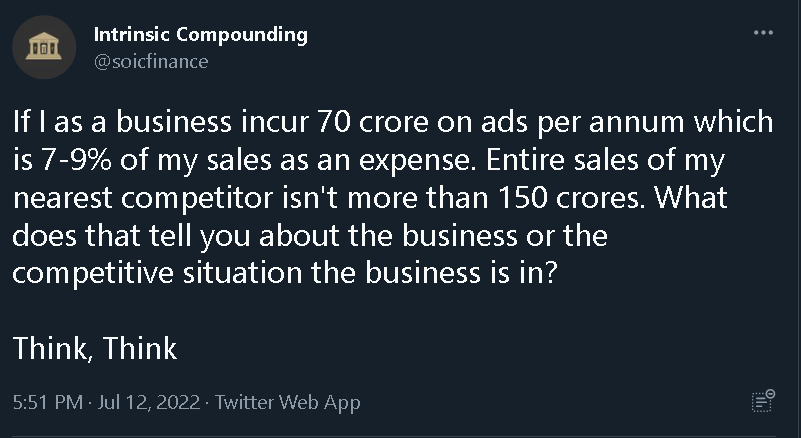

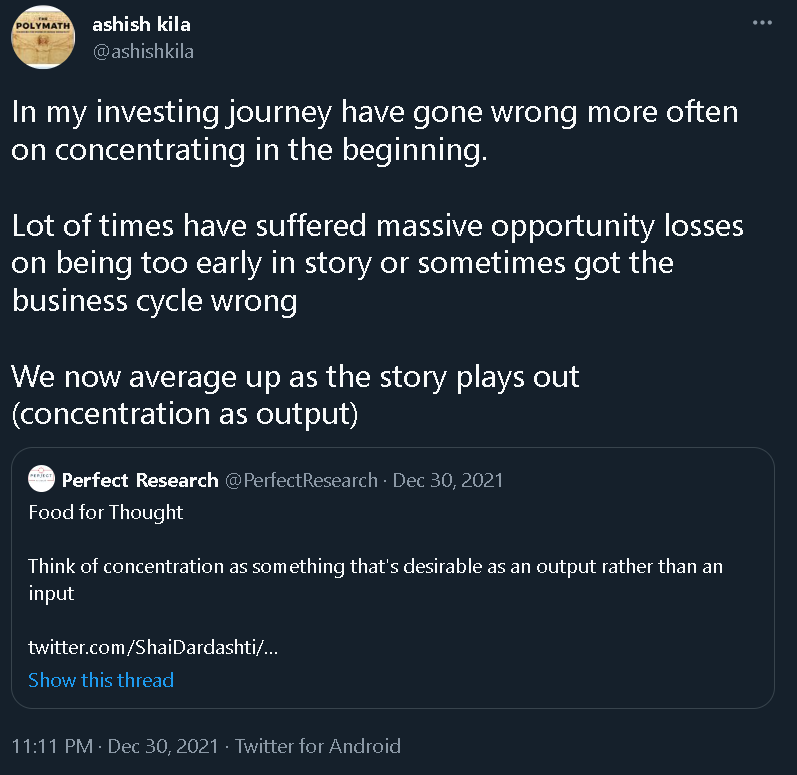

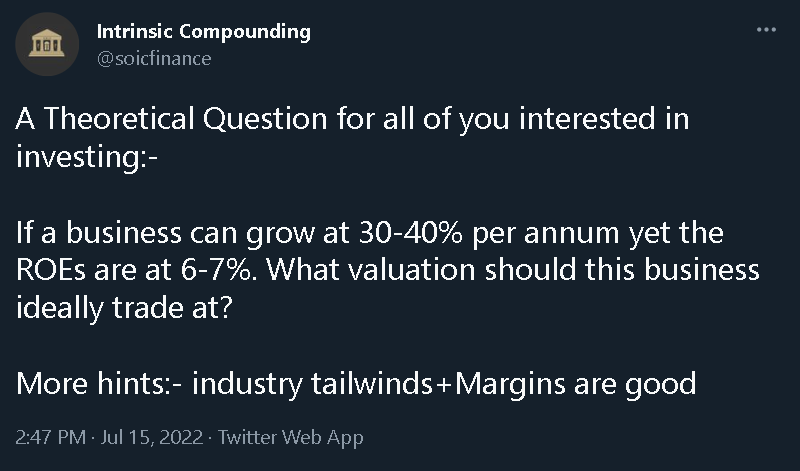

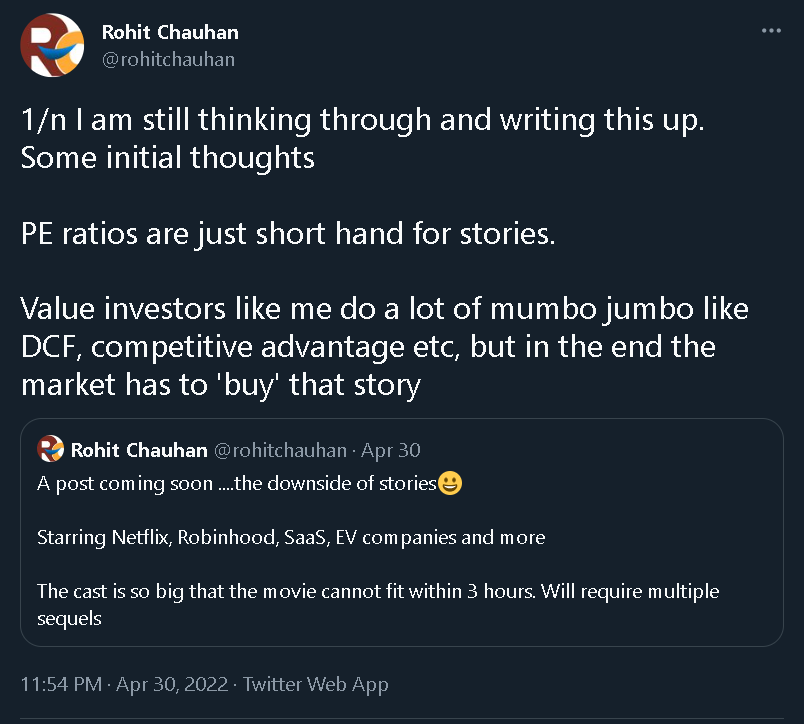

Here are some examples of value addition tweets:

The list could go on and on. These were the readily available tweets which I decided to upload here.

There is a very thin line to identify the difference. There won’t be much difference in what a real person who understands the subjects and the fake person says but the difference lies in how they talk about the effects or consequences of the thing they are talking about.

For example: Talking about ROCE without understanding how change in working capital can affect it. But most of them get away by stating, “Single digit PE company with 20%+ ROCE”.

If one applies their common sense and thinks calmly whenever they come across a tweet from a Reel Investor/Content Creator you can identify it very easily.

P.S: Had written this essay almost a month back but didn’t publish as the tone felt a little aggressive but then after the Vauld incident, I got all the more reason to publish this essay.