Link to Twitter thread: link

Initially when I started out I used to ignore what anybody would have to say about their style of valuing a business and I would blindly copy what Benjamin Graham’s book, The Intelligent Investor, had to say. Later came a stage where I realized Benjamin style was not working for me and I was doing something wrong.

Before we get into the learning, here is the background to it:

If you have been following me for the past 1 year you would have noticed how my valuation method has changed. I used to struggle a lot with valuation and it would be at the back of my mind the whole day thinking what are these investors doing to value. I tried DCF but that didn’t work for me. (Don’t hate me for that, its my personal choice)

I used to attend Bloomberg Quint’s talk on Zoom, message investors, read books, etc. to figure out: How to value? (The frustration had got to a level that I took break from investing for 3-4 weeks)

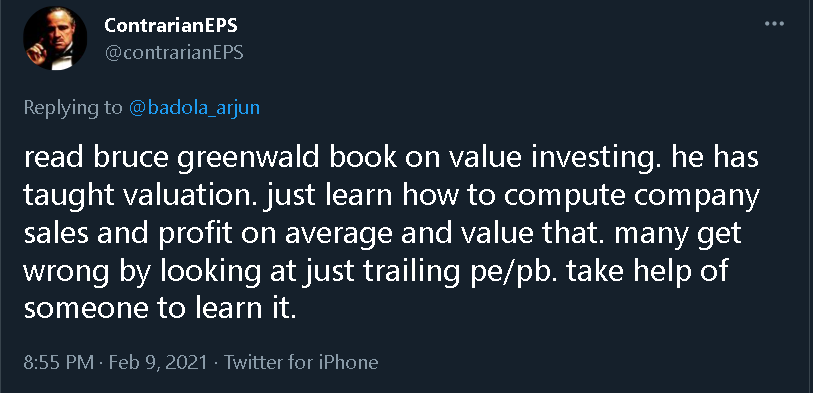

I had asked contrarianEPS on how to value and this is what he replied:

“Take help of someone to learn it” is the crucial line there.

Soon I met Ishmohit via Twitter and that’s where I started to get clarity on valuation.

Again if you have been following me for more than a year, I used to be the “CCL Product guy”. I was so bullish on the company that I had my 70% portfolio in it. (Don’t worry, I have got better in portfolio allocation overtime - thanks to Ishmohit, Ashish Kila sir, and Ashwini Damani sir)

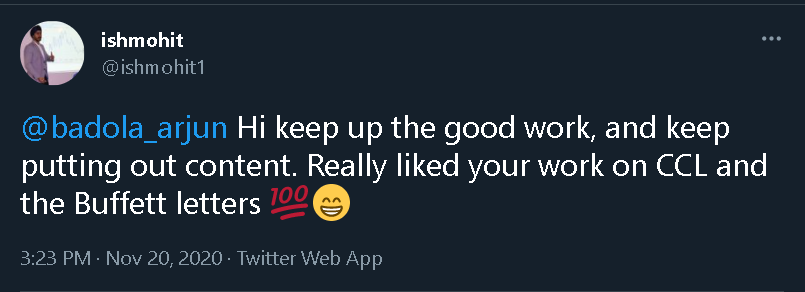

One of the best days in my investing journey was on Nov 20, 2020 when this happened:

After we connected over call and discussed various businesses, especially CCL Products because we both were tracking it very carefully. Soon, he offered me to write blogs for SOIC and that is where the learning started.

Coming to the learnings, mostly I try to make a bet when it fall in the falling three categories:

First: Good business available at extremely cheap valuation

In this situation the business analysis provides you insights that you understand such a business should not be trading at current valuation.

The business has growth triggers, the industry cycle is getting started, problems which the business is facing are short term, etc.

The example for this situation would be companies like

- ICICI securities: The business is not the old broking firm it used to be. Management has realized that discount broking is the real threat and their platform sucks. Now, they are focusing on their strength and trying to leverage their brand of ICICI. But such businesses are deep cyclicals and one can only enter when the valuations are extremely depressed. I entered when the business was trading around 13-14 PE, the industry structure was changing, and the market was booming. But as I said these are cyclical stocks so I reduced my position at intervals when it hit 20 PE but I still hold the business.

- Manappuram Finance: This gold lending business is another one which falls under this category. The business is currently facing short term competition from banks as they entered Manappuram’s territory and started gaining market share in the high customer segment but I feel management is learning from their mistake and the fundamentals are going to improve. Totally visible from the latest concall where they finally changed their loan tenure. Someone I admire had mentioned that, “Don’t worry about the stock performance. One day it will get so cheap that it has to rerate.” :)

But one thing I still have to learn here is when to get out, because sometimes it can take years for the stock to rerate. Right now the whole market is in a bullish phase hence it is easy to say for me that rerating would happen, but if it doesn’t such stocks become difficult to hold.

Second: Great-Good business with reasonable valuation.

In this situation you would be able to identify that there is a Great-Good business which on the face of it looks expensive but actually available at reasonable valuations. Here you won’t be able to make the call independently. You need to talk to smart investors out there, in my case my mentors, and understand what they think about the business. Getting a third opinion matters a lot as you don’t want to blind fold yourself. Once, you get their feedback and you realize that you are not being irrational then one goes ahead with the bet.

In this category falls the music streaming business Saregama.

For full disclosure my buying price was around Rs.2400 and it became a multibagger for me with the highest allocation.

Let’s look at the chart when I was buying:

The stock was already 10-11x from its March 2020 lows and trading around 40 PE. My first reaction was, “Dammit! I missed the bus.” I saw the chart and looked at the 1999-2000 peak and thought “Aur kitna upar jaayega”…

Ishmohit is very bullish on this company, so I asked him that the business has already gone 10x why would you buy it now? He said absolute valuation matters. New facts of the business were emerging as their Caravan sales went to zero, the hidden gem came into the limelight. That is where I got confidence to reject the chart and focus on the business and it’s been a good journey so far. :)

Their music streaming was growing above 20% (rather they have increased the guidance to 25-30% now), industry tailwinds were such that as more people would buy streaming services their profit would increase multiple times, no threat from new entrant (except foreign players), Top player was losing out focus on the music business, visibility of growth for next 2-3 years etc.

Third: Good business but can’t compromise on valuation.

Over here, one identifies a good business but the entry valuation is very important here. As with these businesses the cycle could change suddenly, their raw material prices could fluctuate, or there might not be a huge moat around the business.

One such industry is Pipes industries. It is a shallow cyclical industry, one has to exit as soon as the cycle ends but due to the nature of the industry one would get time to exit. You would start getting signals that their end consumer industry has started facing headwinds and now could be the time to exit. But yes, it is not that simple and that is why entry valuation matters which provides you margin of safety for wrong exit.

Apollo Pipes is an example of such a situation. I was a little late to read this business and missed the opportunity. I couldn’t buy a small player at 40 PE, 3.5 Price to Sales, and with lowest return ratios in the hope that management would perform. The risk to reward was not in favour. But the same was not true with Prince Pipes, they are one of the top 4 players in the industry, with the required capacity and distribution system, and with a good brand name. The only thing required was better execution of the management with relatively favorable valuations at around 30-35 PE, price to sales less than 3, fast grower, and among the top players.

Inshort

The mistake in the first situation would be opportunity cost. In second, it would be the risk in identifying the wrong business and in third it is overpaying for the business.

There is a lot of wisdom out there on how to value but such abundance is the problem itself. One would say follow DCF another would say relative PE is just fine. But the best way to learn is, like how contrarianEPS advised, find a mentor whose approach you admire and learn under them.