In this essay, I will make an attempt to make a case for NOT investing. I have previously written about how difficult investing is, this will be my second attempt on the same topic.

Time would be the most solid argument for not getting into active investing as it is a limited resource which cannot be bought. Some moments in life can be lived only at a certain age or phase of life, which you don’t want to be spending reading annual reports (Life is Short). Further, doing active investing while you are working is extremely difficult and increases the probability of you becoming a jack of trades.

In one of my previous essays, “The urge to do more”, I have written about opportunity cost. Law (college) and Investing (self developed interest) were two boxes where I spent my most time. I was arguing to not develop a third box (interest) as it would bring in unnecessary pressure. The cake (time) would be divided among three activities now, each activity getting less of it. But even having two boxes acts as a barrier to success, as one of them would have to give way to another at some point.

Having free time is very crucial. One should observe what their mind decides to do when they have free time. If you occupy yourself with something outside of your field (which is fine) but take away the opportunity of letting your mind wander around (but within the primary career field) to explore interest with a free mind. Keeping up with news, reading about new tech in your field, stories about famous people, etc. new ideas can come from anywhere. This leads to you exploring the subject deeper and then serendipity doing its magic.

I remember watching this video in 2021 and didn’t care much about it thinking, “This time it’s different” or “I am different”. But deep down I knew this problem will soon come, one can only delay it by ignoring it.

The important part of the video is at 05:25, when they deal with the question of “what about learning to invest during your free time?” I feel Tanay gives very practical advice here. He advises to use that free time by investing that time back into your primary growth segment i.e. your job. It could be via improving your knowledge or the quality of work you do. Hence, the two boxes I mentioned in my previous essay should be reduced to one box at a time and if you are still spared with free time, go have some fun!

We cannot ignore the point that Varun Mayya, mentions in the video as well that career is more stable than investing as in the latter you are at the mercy of the market.

When I met Rajashekhar lyer, I remember him mentioning during his talk that market returns can be achieved with little effort but for generating that alpha of 2-3% requires disproportionately larger efforts. I believe people really undermine the words “disproportionately larger efforts” here.

If you are new to investing, probably joined after 2020, you might just laugh after reading this essay and carry on with your investing journey thinking you are already beating the market. But realising that investing is hard takes time. You have to wait for your luck to run out. Life to start bringing in responsibilities. Realising that money is not the goal. Prioritising time for the loved ones. Don’t fool yourself by the extraordinary returns you might have made during recent years. Note down the quote below:

“If you’re a duck on a pond, and it’s rising due to a downpour, you start going up in the world. But you think it’s you, not the pond.” - Charlie Munger

Rohit Chauhan has written two articles on this topic (“Investing to be rich” and “A future advise to my kids”) and they have been very impactful for me with regards to my decision of being an active investor. Do read the comment sections of these two articles, some very good pointers are mentioned there.

Here is one snippet from the first article:

Another snippet from second article:

Rohit also mentions that it takes around 8-10 years of investing for someone to break even and compounding at 20%+ CAGR is something achieved by exceptional investors and results of that will also be back ended.

This means two things: first one has to put in 8-10 years of time into learning this skill and as the result of it will be back ended one can only tell after years of practice whether they are that exceptional investor. Plus, if you are working one has to honestly ask themselves whether they will be able to put in the hours required to become an exceptional investor compared to someone whose day job is investing?

Hobbies are great to have. They help you relax when you want a timeout from your primary world. But when you connect money with your hobby a different kick comes in.

If investing is your hobby/passion/side-hustle, one has to be super careful of not letting the short excitement of doubling your money, blur the long term benefits of focusing on your primary job.

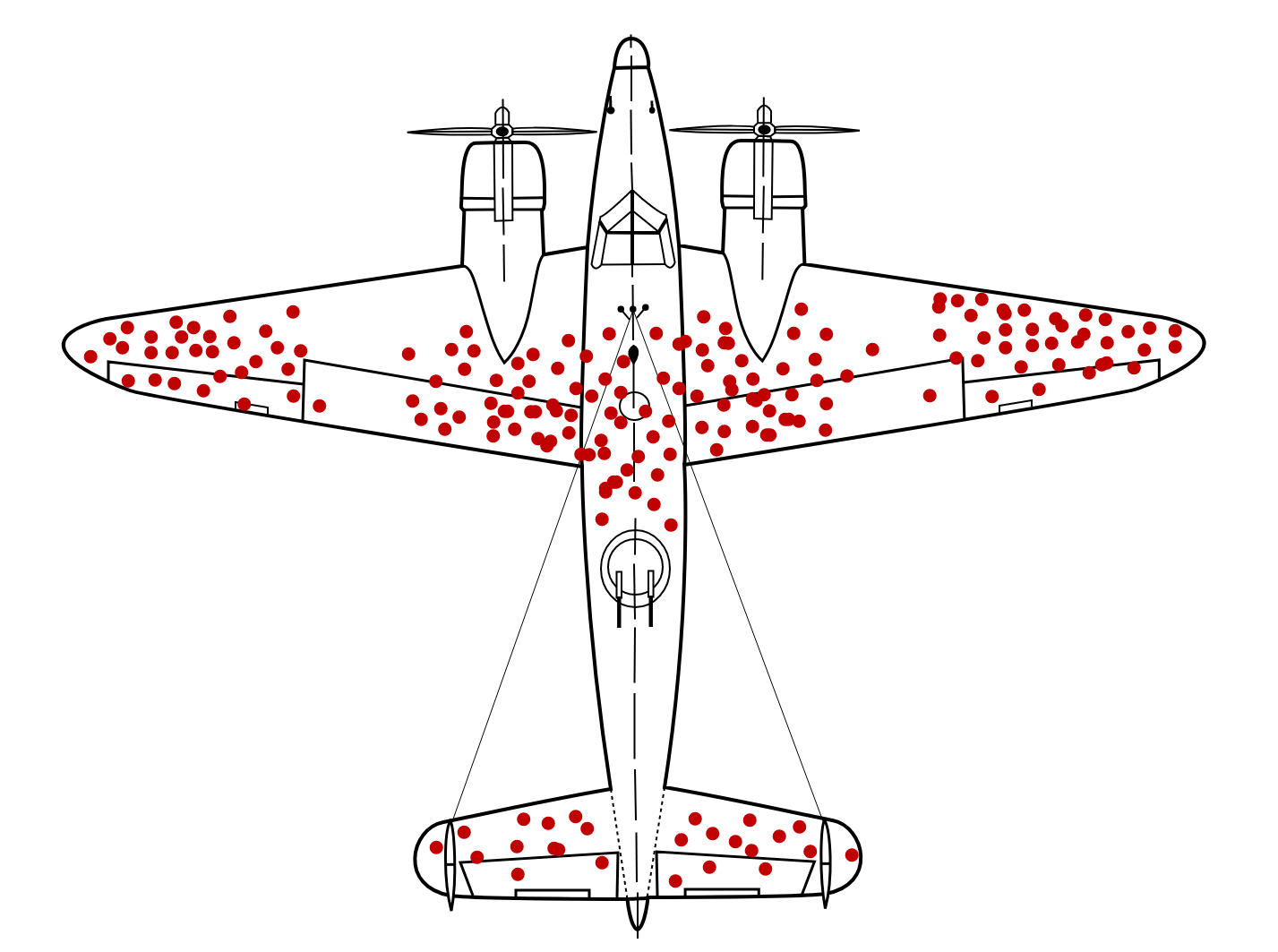

Don’t fall for the stories of famous investors who becomes crorepati starting with Rs.5,000/-

If you don’t know what the above picture represents then visit this article.

For the sake of the argument, let’s assume even after all the hard work one can put in and let the serendipity drive you to explore, you still have time for living a life.

I feel investing would still not fall into the priority list, as then comes your family/friends. Creating memories is far more important than compounding your money at 20%+ CAGR. (Which most people can’t do, even after disproportionately larger efforts)

If after reading this you believe that “No, investing is my passion” then that’s great. The aim was to make you rethink and question.

One has to be careful and not get into situations where you might win the battle but lose the war. :)

P.S: On personal front, I have decided to shift to index funds and focus on the primary field in my life as growth there is at the supreme importance and doing active investments would eat away my time from that. Have met wonderful people and mentors in past 3-4 years and I am very thankful to them for sharing their knowledge with me.