After reading books on investing, watching interviews, gaining some first hand market experience, etc. we are often faced with a question: How to generate stock ideas?

Today I will be sharing some ways I try to look out for stock ideas.

Look Around

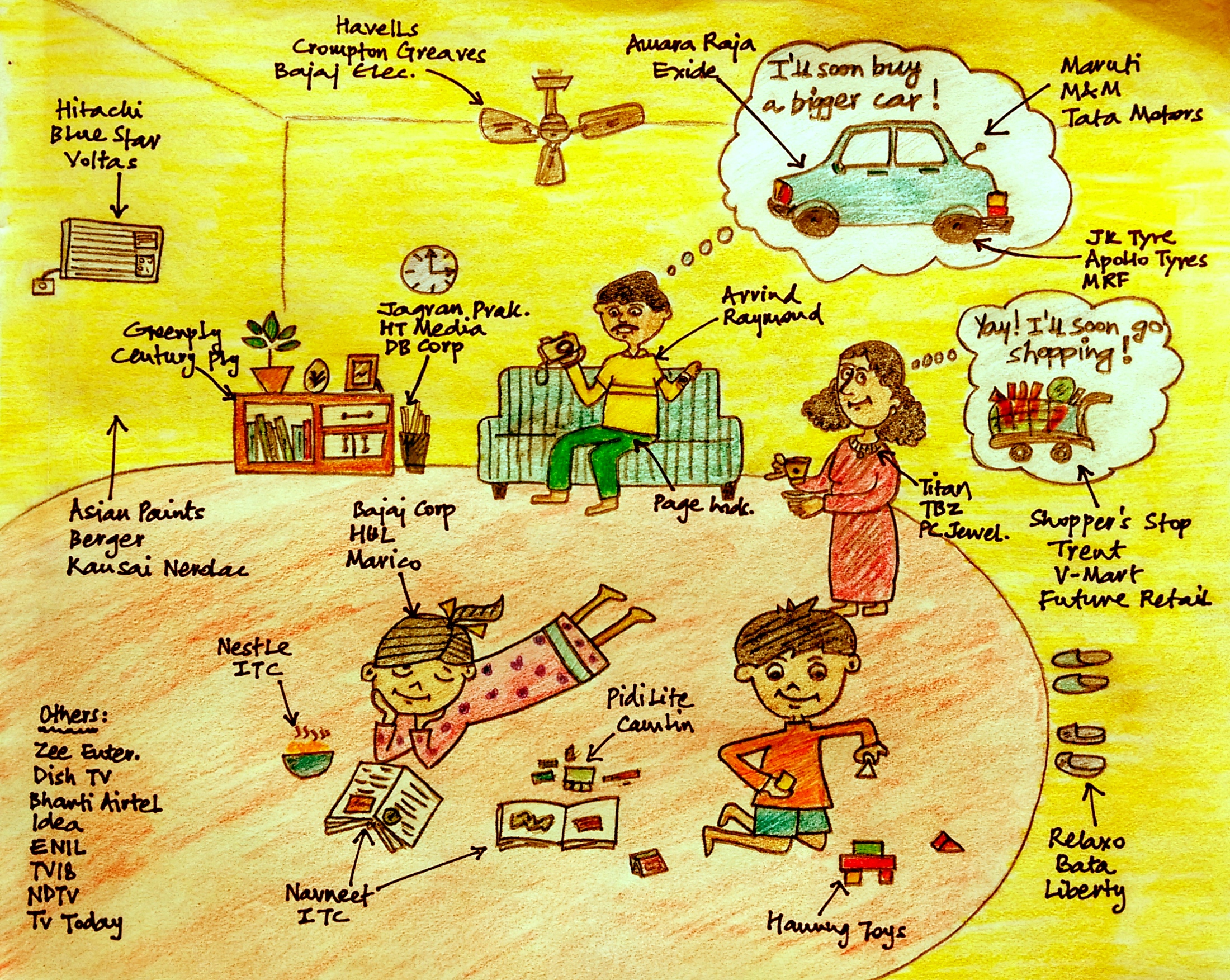

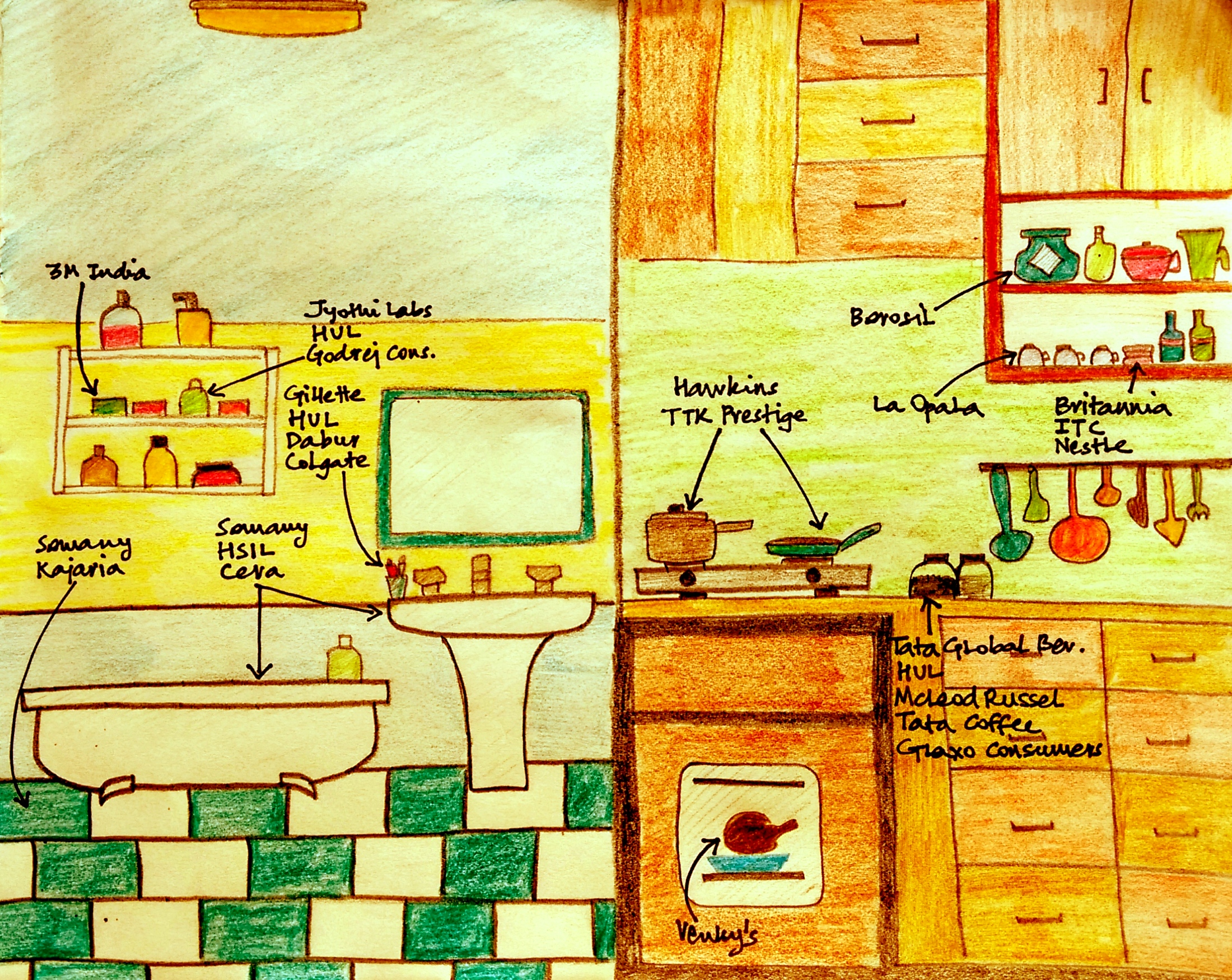

The most simple way is to look around yourself, at your home, workplace, while travelling, etc. and start analyzing those companies.

There would some products which you might be using for years and understand why nobody else is able to take away their market share.

Look at the photos made by Safal Niveshak:

Here is another photo, but this time from Basant Maheshwari’s book: The Thoughtful Investor

This approach gives you an edge in terms of knowing how the products actually delivers.

But this has one downside.

Most of the times these companies are already recognized and have been overvalued by the market.

Therefore it gets very difficult to get a fair price for such companies.

Other People’s Portfolio

Checking portfolio of well known investors is also a good way to generate stock ideas.

Let me be clear here, I am suggesting to look for ideas and not just clone their portfolio without building up your own conviction.

Cloning without conviction can be really injurious to your wealth.

By looking at other people’s portfolio you will be exposed to various industries.

Study about the industry, understand how many players are involved in it which includes the ancillary industries to it.

Like for a auto company the ancillary industry would be auto parts, tyres, companies that make parts for tyres, etc.

One tip: go up and down the value chain to see which company makes the highest profit

For example, if you look at the coffee industry the most money is made by processors.

The downside for this approach is that you will be faced with a lot of biases. If your favorite investor buys a companies there is high chance that even you will start liking that company.

For checking other famous investor’s portfolio you can visit: Trendlyne

Websites/Blogs

Subscribing to blogs and websites which provide you with portfolio update is another way.

Reading blog articles on investing many times leads to discovery of new ideas.

For example: If you were reading an article on how Nestle is the market leader in baby food, Royal Enfield in bikes, ITC in cigarettes, etc. this can lead to, you applying these models which have successfully worked on companies which are yet to be recognized by the market.

You can also follow some twitter handles which provide you with bulk deals that happened in a day or you can also use #Bulkdeals in the twitter search. I follow Manish Mall for the same.

Newspaper

With this approach one needs to be very careful.

One must remember that reading newspaper could be really toxic for your mental health as well as your wealth.

Getting updated with news of market will sooner or later drag you in taking actions which you shouldn’t.

Reading newspaper will affect your emotional behavior a lot and it will make it difficult for you to hold stocks for long term.

As when you would read everyone panicking and selling as if the world is getting destroyed you would want to reciprocate.

This what happened on Mar 23rd which led to people becoming a victim of herd mentality.

Mental Models

Always keep some mental models in your mind which will help you recognize the opportunity around.

Like knowing the concepts of Moats will help you recognize when you see a company with competitive edge.

If you start thinking from your common sense then even that could lead to generating of ideas

Think about a company which has a lot of power with it.

It could pricing power, some unique/patent product, incredible management, only manufacturer, etc.

Just thinking like this will automatically generate ideas for you.

Once you get some companies then you can go around the value chain or check their suppliers/customers and find some other hidden gems.

I would suggest worry about financial matrix later, first find a great company and understand what it takes to be great.

Lastly

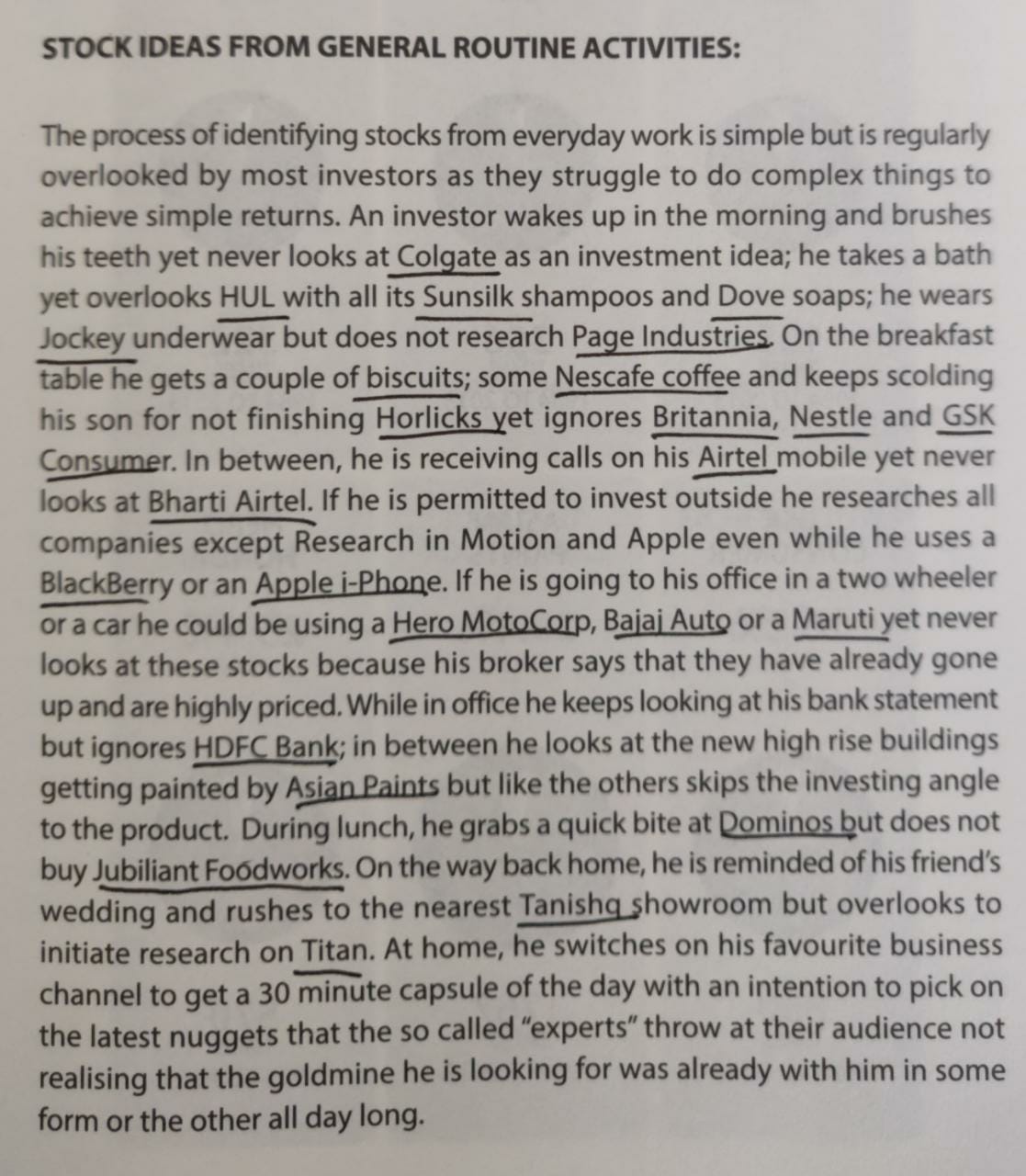

If nothing works out, then my friend do as Warren Buffett says.

Here is snapshot of an interview of Warren Buffett with Adam Smith in 1993:

Adam Smith: If a younger Warren Buffett were coming into the investment field today, what areas would you tell him to point himself in?

Warren Buffett: Well, if he were coming in and working with small sums of capital I’d tell him to do exactly what I did 40-odd years ago, which is to learn about every company in the United States that has publicly traded securities and that bank of knowledge will do him or her terrific good over time.

Smith: But there’s 27,000 public companies.

Buffett: Well, start with the A’s.

So, if you are not able to generate any ideas by following the initial methods then do as Mr. Buffett say.

(Warren Buffett did this twice by going through Moody’s Manual)

Hope this article answers your question, ‘How to generate stock ideas?’.